Selling Your Agribusiness: What to Expect

What does the sale process involve?

Every buyer’s approach is bound to be a little different, but the general flow is fairly standard.

For more perspective on the process of selling a business, watch this webinar by Dorsey & Whitney LLP.

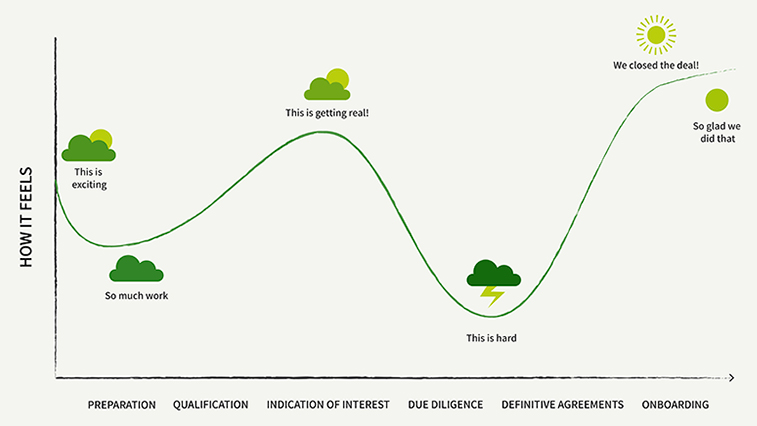

The Winding Road to Selling Your Business

At times, the process can feel like an endurance test because while you’re focused on the sale you still also have to run the business. It’s important to expect ups and downs along the way. Having a good understanding of what’s involved always helps make the journey go smoother.

The “Expect” Phase

Setting and clarifying expectations

1

Qualification

Once you’re confident your business is ready for market, potential buyers will sign non-disclosure agreements (NDAs) with you to review your finances, business performance and market position at a high level.

If your company meets the buyer’s criteria, they’ll do some calculations to arrive at an initial valuation — a preliminary purchase price that you will see in the indication of interest.

2

Indication of Interest

This step involves signing a short (usually two-page) non-binding offer from an interested buyer. That offer may be called an indication of interest (IOI), an expression of interest (EOI) or a letter of intent (LOI). It will include the initial valuation and key deal terms such as transaction structure, employee matters, closing balance sheet items, approvals and timing.

The “Inspect” Phase

Testing expectations against the facts

3

Due Diligence

If you haven’t done so already, this is when you should tell your key people about the sale. The buyer will want to consult them while looking more closely at the business to validate the information you’ve shared and test their own assumptions. Based on what they find, they may adjust their valuation or deal terms or choose to abandon the purchase.

With all the disclosures made up to this point, sellers sometimes wonder why a buyer wants to know even more as part of due diligence. It’s not personal and it’s not that the buyer doesn’t trust you: it’s just that every assumption needs to be confirmed for the deal to go ahead with confidence.

4

Definitive Agreements

If the buyer decides to go ahead, they will create a set of definitive agreements. These reflect anything and everything pertinent that’s been discussed throughout the sale process: executive agreements, confirmations of executive agreements, valuation adjustment, earn-outs, hiring for key roles (controller, general manager), etc.

These are substantial legal documents that include the purchase agreement as well as any escrow, commercial or other agreements, and will require a lawyer’s review.

At this stage, you’ll also work with the buyer to create an onboarding and integration plan. The better prepared your business is, the faster these steps will go.

The Sale and Beyond

Completing the handoff and moving forward

5

Onboarding & Integration

As the deal is closing, onboarding and integration kick into action. Some of this happens pre-close and some happens post-close.

Onboarding is about transferring control of the business to the buyer. At Market Maker, we have a dedicated team to support this part of the transition.

For us, integration is about making the business a seamless part of our portfolio — including setting up new governance and reporting structures (which require a qualified accountant in a controller role), and developing a strategic plan.

The goal of these steps is ensuring operational continuity throughout the transition. It’s also about welcoming your employees into the Market Maker portfolio, putting them at ease, setting expectations and helping them understand the benefits of the new arrangement.

6

Sustained Growth

All of the preceding steps put the business in a position to grow incrementally as part of our portfolio.

Going forward, our Market Maker team works with company management to share and exchange best practices, strategic advice, insights, analysis and more — all to ensure the business continues to thrive and gain strength for years to come.

For more on this stage, see our “What happens after I sell?” page.